Hsmb Advisory Llc Can Be Fun For Everyone

Hsmb Advisory Llc Can Be Fun For Everyone

Table of ContentsThe Best Guide To Hsmb Advisory LlcHsmb Advisory Llc - An OverviewTop Guidelines Of Hsmb Advisory LlcThe smart Trick of Hsmb Advisory Llc That Nobody is DiscussingHsmb Advisory Llc for BeginnersSome Known Incorrect Statements About Hsmb Advisory Llc

Ford says to avoid "money worth or long-term" life insurance policy, which is even more of an investment than an insurance. "Those are really complicated, featured high compensations, and 9 out of 10 individuals don't require them. They're oversold because insurance coverage agents make the biggest commissions on these," he states.

Disability insurance policy can be expensive. And for those that choose for long-lasting care insurance, this policy might make handicap insurance unneeded. Find out more regarding long-lasting treatment insurance and whether it's right for you in the following area. Long-term treatment insurance can aid spend for expenses linked with long-lasting treatment as we age.

Getting My Hsmb Advisory Llc To Work

If you have a persistent health and wellness issue, this sort of insurance policy can wind up being critical (Health Insurance). Do not allow it emphasize you or your financial institution account early in lifeit's typically best to take out a plan in your 50s or 60s with the expectancy that you will not be using it until your 70s or later.

If you're a small-business owner, take into consideration safeguarding your source of income by purchasing business insurance. In the event of a disaster-related closure or duration of rebuilding, organization insurance can cover your revenue loss. Take into consideration if a considerable climate occasion influenced your shop or manufacturing facilityhow would certainly that impact your earnings?

And also, using insurance can occasionally cost even more than it conserves in the lengthy run. If you obtain a chip in your windshield, you might consider covering the repair service expenditure with your emergency situation savings rather of your automobile insurance coverage. Health Insurance St Petersburg, FL.

The Ultimate Guide To Hsmb Advisory Llc

Share these tips to safeguard enjoyed ones from being both underinsured and overinsuredand seek advice from a trusted specialist when needed. (https://www.easel.ly/browserEasel/14439798)

Insurance that is acquired by a specific for single-person protection or coverage of a family members. The specific pays the costs, rather than employer-based health insurance where the company frequently pays a share of the premium. Individuals might buy and purchase insurance from any kind of plans available in the person's geographic area.

Individuals and households may qualify for financial support to reduce the expense of insurance premiums and out-of-pocket expenses, however just when enrolling via Attach for Health Colorado. If you experience certain adjustments in your life,, you are qualified for a 60-day duration of time where you can enroll in a specific plan, even if it is outside of the yearly open enrollment duration of Nov.

15.

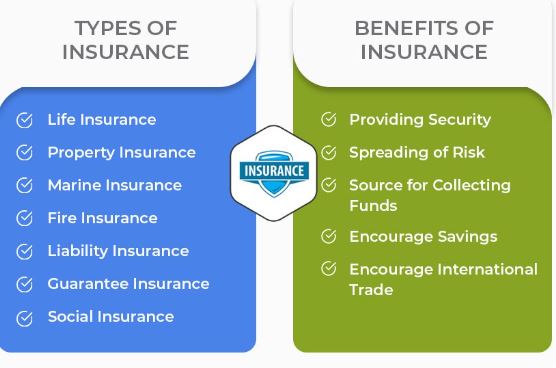

It might seem basic yet comprehending insurance kinds can also be puzzling. Much of this confusion comes from the insurance sector's recurring objective to design individualized insurance coverage for insurance holders. In developing flexible policies, there are a selection to pick fromand every one of those insurance policy kinds can make it hard to recognize what a details plan is and does.

5 Easy Facts About Hsmb Advisory Llc Described

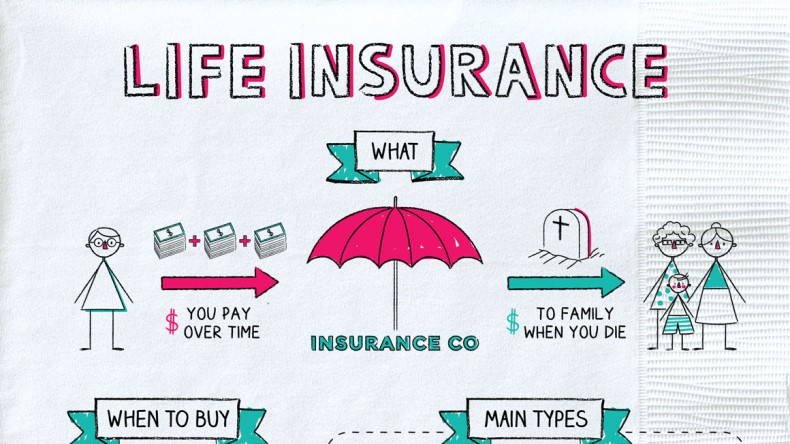

The most effective location to begin is to discuss the distinction between both types of standard life insurance policy: term life insurance policy and permanent life insurance. Term life insurance policy is life insurance coverage that is just active for a time duration. If you pass away throughout this duration, the individual or people you have actually called as beneficiaries may get the money payment of the plan.

Nonetheless, lots of term life insurance policy policies allow you convert them to a whole life insurance policy, so you don't lose insurance coverage. Generally, term life insurance policy plan premium payments (what you pay monthly or year into your plan) are not secured in at the time of acquisition, so every 5 or 10 years you own the policy, your costs can increase.

They additionally tend to be cheaper total than whole life, unless you get an entire life insurance coverage policy when you're news young. There are also a couple of variations on term life insurance policy. One, called group term life insurance coverage, prevails amongst insurance alternatives you may have access to through your company.

The Best Strategy To Use For Hsmb Advisory Llc

An additional variant that you might have accessibility to with your company is additional life insurance., or funeral insuranceadditional coverage that could assist your family members in case something unforeseen takes place to you.

Permanent life insurance policy simply refers to any life insurance coverage plan that doesn't run out.